THE PLAY REPORT: HEALTH & BEAUTY RETAIL

12th September 2019

For trends in new retail, it’s hard to find an industry that has adopted the mantra ‘deliver an experience’ more than the health and beauty sector.

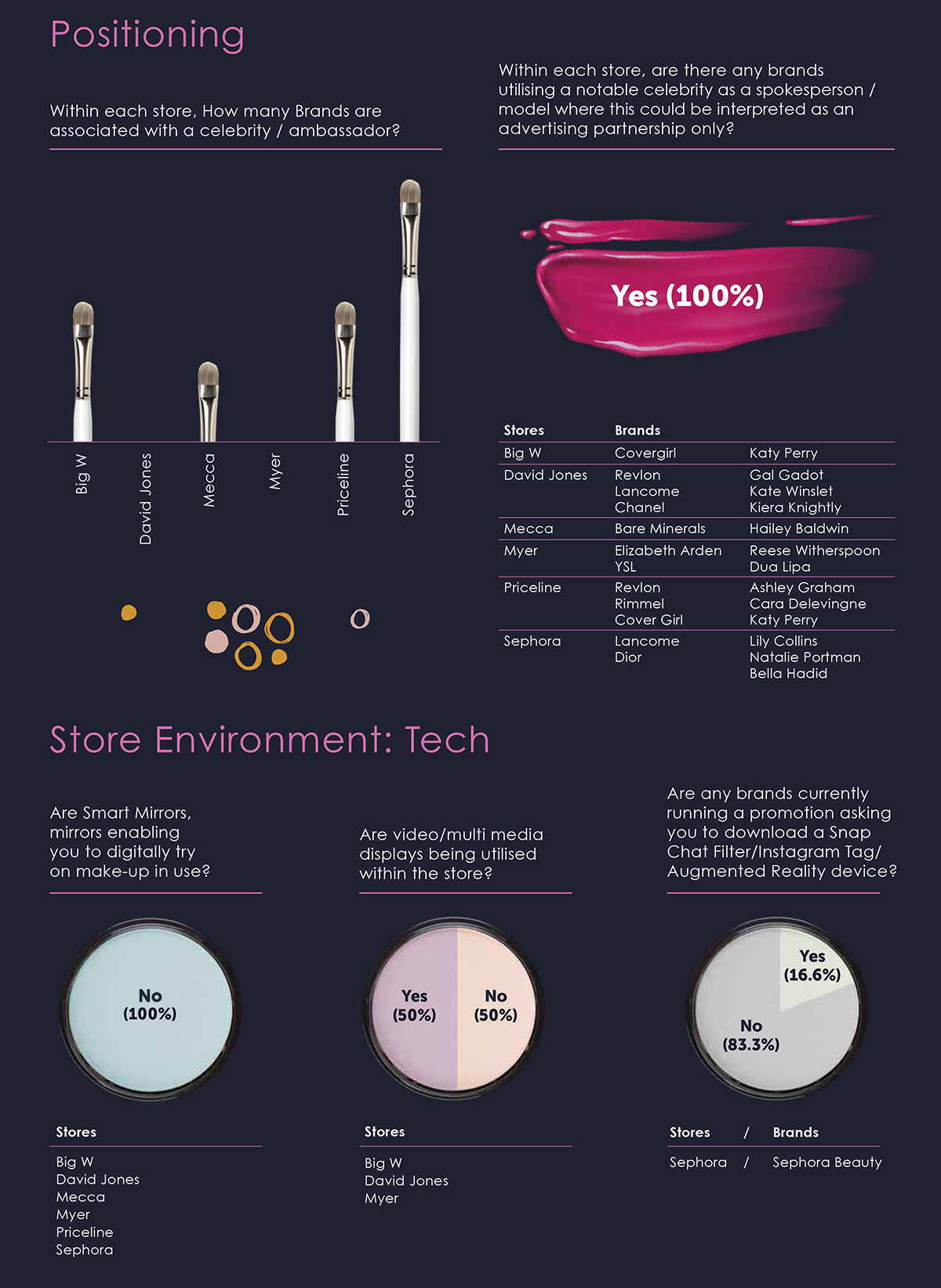

With many of the big players in beauty at the forefront of emerging tech – think L’Oréal’s recently acquired augmented reality and artificial intelligence entity, ModiFace, weekend-long activations like Meccaland and NARS interactive sensory celebration in London – to hands-on experiences like Mecca’s instore tutorials –when it comes to instore theatre, health and beauty is delivering on a level that would make P.T. Barnum jealous. But is this translating across the market? How are smaller brands, without the budget of a Kylie Jenner responding to the call for tech in their customer experience, and do customers really mind either way?

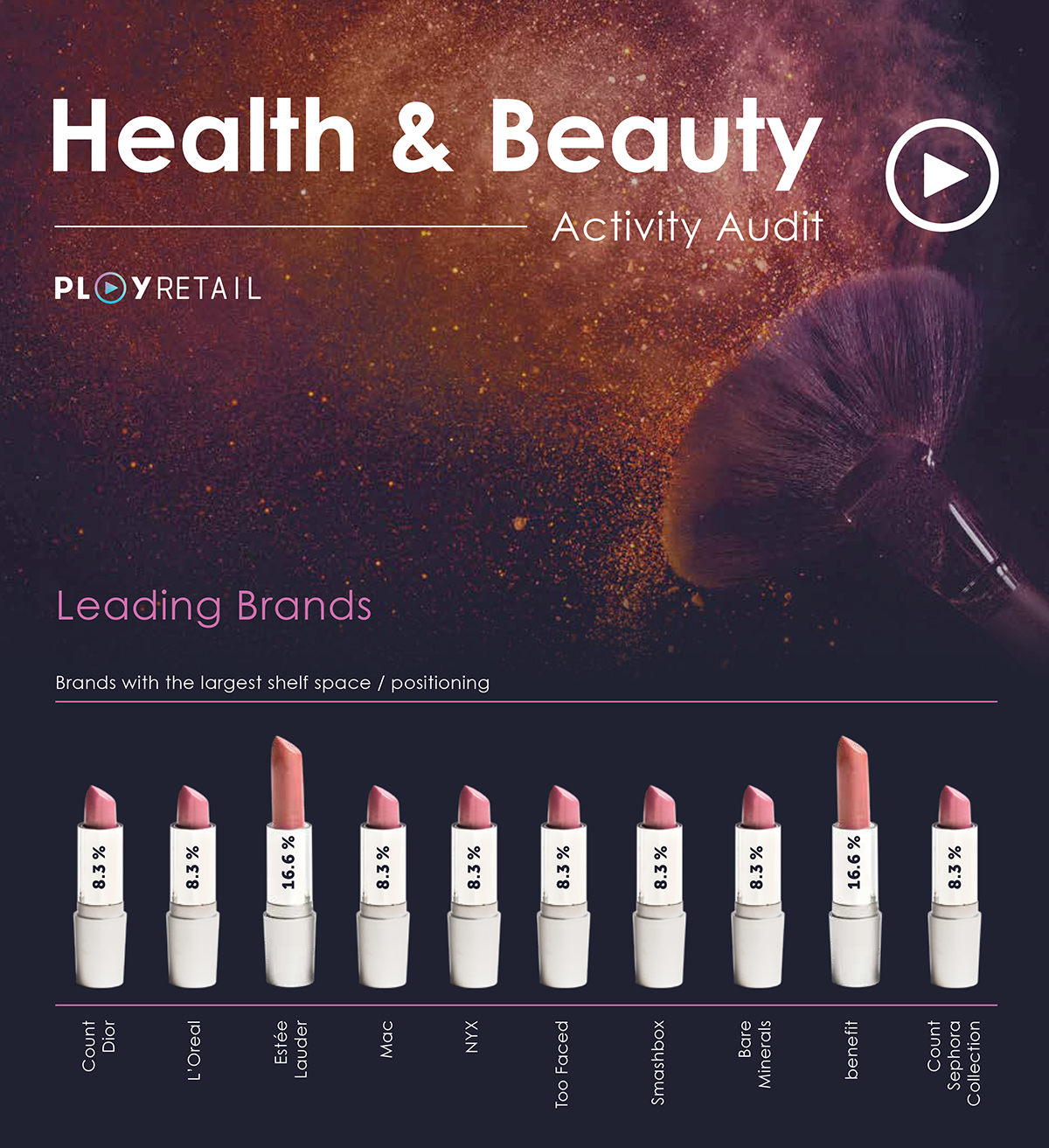

This month Play looked to 6 key health and beauty channels within the Australian market to see how our retailers are delivering their customers an interaction worth a ‘gram, and which brands are commanding the most attention at the shelf.

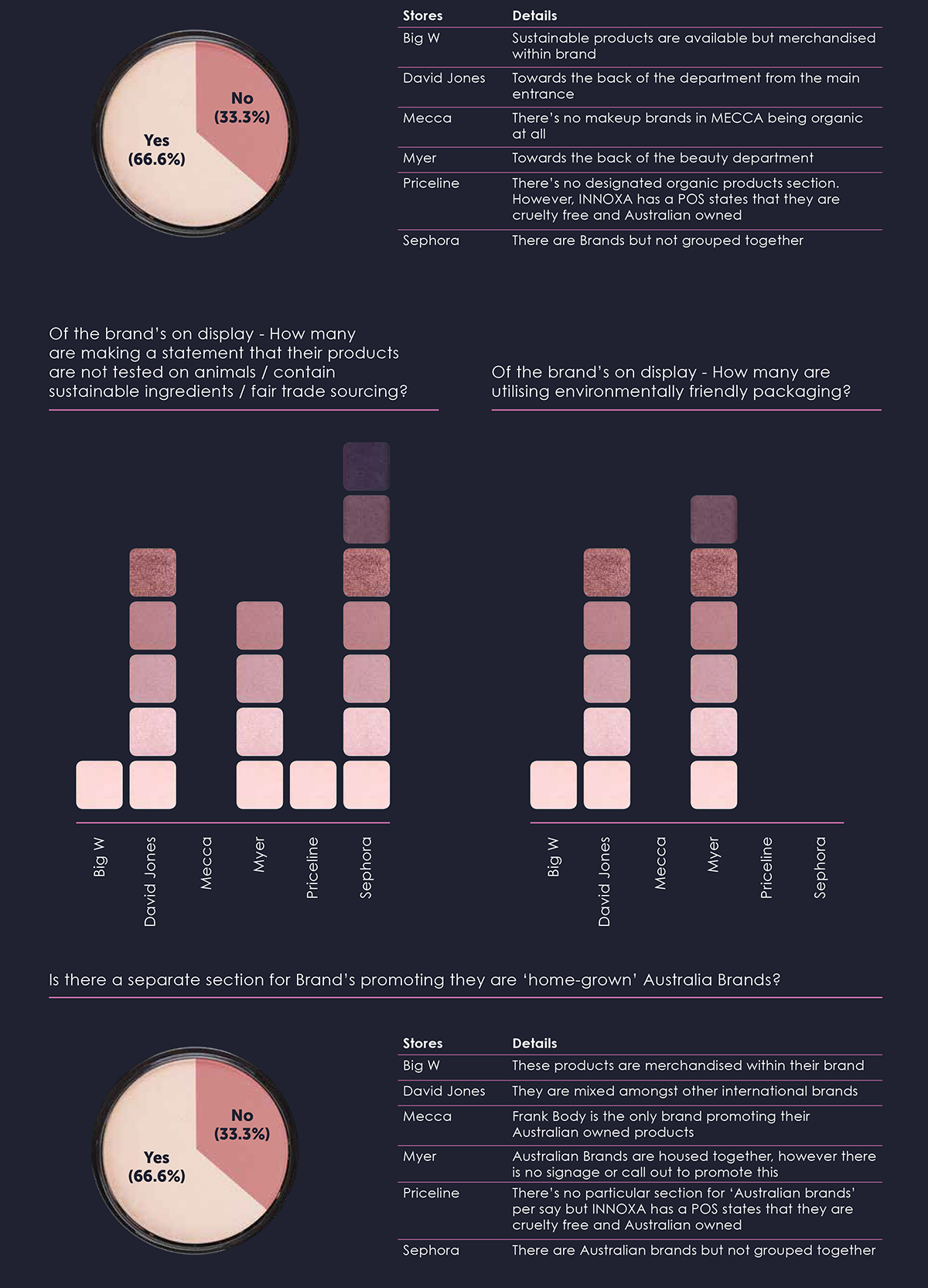

We also took a particular focus on the growth of Australian made and products with an organic or sustainability pledge. Over the past six months, we’ve seen an increased focus across the market on the use of sustainable packaging, this ethos is now extending into reducing plastics in packaging and the entire product life cycle for many brands in the beauty sector. Think innovative names like Ethique, Lush and Seed Phytonutrients who use only paper packaging. Our report examines who is really driving the sustainability message at retail, and how well is it being communicated.

See our findings below.

Stores visited

Mecca

David Jones

Sephora

Myer

Priceline

Big W

INTERESTED IN ANALYSING YOUR BRAND OR SECTOR?

Our powerful and effective data collection software and technology matched with our impressive geographical people reach, allows us to gather valuable market insights for our clients. Customised to provide regular feedback that is important to your business, our Market Insights can include analytics such as:

– How VM time was spent in store, refill time vs merchandising time

– New product drop availability/store processing delays

– Stock levels including any low stock red flags

– Compliance to POS and VM guidelines

– Competitor activity

– Sales metrics